A lesson many newcomers learn when they arrive in Canada is that you need credit to pay for large expenses, buy a car, or purchase a home. However, it’s difficult to borrow without a credit history in Canada. Canadian lenders typically check each applicant’s credit files at one of the main credit reporting agencies (Equifax Canada and TransUnion). This file is like a financial report card that tracks how much you borrow and how quickly you pay it back, to calculate your credit rating and credit score.

Without a credit history, newcomers may need a loan co-signer with a Canadian credit rating, and considerable assets as collateral, or they must demonstrate a history of stable income in Canada to receive a loan. Fortunately, you can start to build your credit record and history shortly after you arrive in Canada.

Advertisement:

Getting Started

The financial decisions you make when you arrive in Canada have a huge impact on your credit history and score. The concept of credit can sometimes lead to a debate about how it can help, or hurt you when you are building your credit rating. On one hand, credit can be a fantastic tool to help you:

- Get a loan or a mortgage

- Save on credit card and loan interest rates

- Get approval for lines of credit

- Obtain certain jobs (i.e. some finance-related roles will require a credit check as a condition of employment)

- Rent a home.

Advertisement:

On the other hand, if poorly managed, credit can haunt you for many years, and make you miss out on financial opportunities. Creditors can run a credit check on you to assess if you are a low-risk or high-risk borrower. They will also decide to grant or deny you a loan or charge you a higher interest rate.

What is Credit History?

Your credit history shows lenders that you are responsible when it comes to paying your financial obligations. Whether that is your monthly rent, utility bills, loans, etc. If you have come from a country where you have credit bureaus, you know how important your credit history is. Maintaining a good credit history in Canada is also important.

We’ll share tips to help you build and maintain a healthy credit report. With a strong credit history, you can save money and have more financial freedom.

So what is your credit score when you come to Canada? Nothing. Think of it as a blank slate. Everything you do henceforth will dictate what direction your credit rating will go, up or down.

Related Posts:

Top 10 financial steps to take before you leave for Canada

Advertisement:

First things to do after landing in Canada

Renting Without a Credit History

No Spend Challenge | A Journey to Financial Freedom

Banking and Finance in Canada: Your First Steps

Your credit history or credit rating starts the first time you get a credit card or loan in your name from a Canadian bank. You can begin by applying for and using a credit card responsibly.

Even if you don’t have immediate plans to buy a house or vehicle, it’s good to establish a credit history, since banks may give special consideration to recent newcomers.

Newcomers may be eligible for a ‘secured’ credit card. A secured credit card is different than a regular credit card because it requires a security deposit equal to the amount of the credit limit. Think of it as a stepping stone to getting an unsecured credit card. Such special offers may be more difficult to obtain later, especially if your income does not grow as fast as you had hoped. A credit card is also useful for larger purchases and as a secondary piece of identification.

Why is Your Credit Score Important?

Your credit score is important for several reasons:

- Lenders will review your credit score when you want a mortgage to buy a home, or a loan to buy a car. They want to understand your payment history, and your ability to manage credit and pay off debt.

2. Landlords will conduct a credit check before renting their property to you.

3. Some employers will conduct a credit check before they make an offer of employment. This is common with banks and other financial institutions such as insurance companies.

What Credit Score is Good?

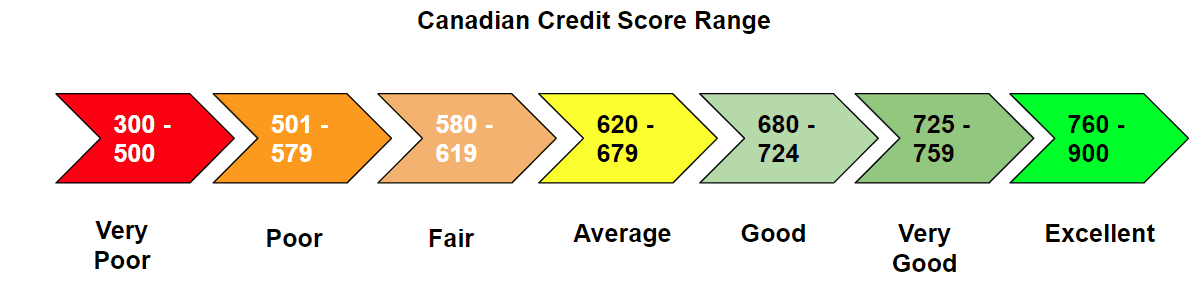

Your credit score can fall between the range of 300 – 900. Generally, and depending on the credit score model that your financial institute is using a good score is greater than 680. As a benchmark, to get a mortgage to buy a house in Canada, you need a credit score between 600 – 700. If your credit score is lower than 600, you will want to take steps to increase your credit score.

Once you receive a credit card, use it wisely to establish a credit score so that lenders will have confidence in your ability to repay loans.

Your credit is scored on a point system that ranges from 300 – 900 points, where 900 is the best score. To qualify for a loan, your score should be 650 points or higher. If you score lower than 650, it may be difficult to get a loan or receive new credit. However, if you have a low credit score, you can improve your score by carefully managing your credit use.

How Much Credit Limit Should I Use?

If possible, avoid using more than 30% of your credit limit (balance-to-limit ratio). For example, if you have a credit limit of $1,000, you should try not to spend more than $300 and pay the bill in full by the due date.

Your credit score may decline if your balance-to-limit ratio exceeds 30% as it may indicate to creditors that you are a higher-risk borrower.

How Many Credit Cards Can I Have?

It’s best to start with only one until you are financially comfortable enough to afford more. Avoid opening many credit accounts. Many credit card accounts can signal financial distress to lenders, especially if they all carry a balance on them.

Why Credit History is Important to Rent a Home in Canada

Your credit history is one of the things landlords want to see before giving out their home to you. Your credit history will tell the landlord how reliably you pay debt. A good credit score will tell the landlord that you are reliable and will likely pay your rent on time. This is important to landlords as it guides them in their decision regarding who to rent their home to and who to avoid.

While this arrangement is great for landlords, it can be problematic for newcomers who are looking to rent a home. If you are a newcomer to Canada, you likely will not have a credit history. It takes a minimum of six months to build a credit history. Because of this, it can often be hard to convince a landlord that you will be a reliable tenant. However, there are some tips that you can follow to rent a home without a credit history.

How Do I Rent a Home Without a Credit History?

The first thing you can do is show proof to your future landlord that you have a good amount of savings in your bank account. This will tell the landlord that you have enough money to pay the rent and will pay it on time.

If you don’t have a good amount of savings, your top priority would probably be to secure a source of income. Once you have done that, you can show proof of income to your landlord. This will also satisfy landlords because it means that you have enough money coming in every month to pay the rent.

There is also another way to get a house on rent without a credit history. Some landlords openly accept newcomers and reserve their homes, especially for newcomers. These rentals may be small and less than ideal. However, they are a good option if you need a place to stay while you build your credit score. Many times, these rental homes have basic furniture like beds and sofas which makes it easier for newcomers to move into.

In the meantime, paying your bills on time and being reliable with all of your payments is a great way to show lenders that you are financially responsible. And over time, you will build a strong credit history that will provide many financial benefits.

How Do I Maintain a Good Credit History? Five Tips to Follow

1. Take Advantage of Your Fresh Start in Canada to Build a Good Credit History

Get a credit card or two, and use them, but use them sensibly. Pay off your balance each month and avoid going over your balance to show potential lenders your reliability.

Paying in full each month will also reduce the amount of interest you pay. And with the average credit card interest rate at approximately 19%, any balance on your credit card can become very expensive. But, if you don’t pay the balance in full each month, be aware of the interest rate charges.

If you can’t pay the full balance on your credit card, at least pay the minimum balance and make regular payments, to pay off debts as quickly as possible. But, avoid missing payments. Missing payments can damage your credit score and make it difficult to get a future loan such as a car loan, or mortgage.

Using your credit card for cash advances is even more expensive. Typically, the interest rate is higher and you pay interest from the date of the cash advance. There is no grace period like there is for a regular credit card purchase.

2. Read the Small Print on Cancellation Fees and Penalties

On top of paying your monthly bills and loan installments on time, you need to be careful when you sign up for services such as cable, telephone, internet, gym subscriptions, and other monthly subscriptions. Check the cancellation fees and deadlines when you sign up for such services. Otherwise, these fees can be high.

Be sure to ask questions about your contract if there is anything that you do not clearly understand.

3. Keep Track of Your Utility Changes

When you move, don’t forget to cancel or transfer your services and utilities to your new address. Sometimes final bills end up in collections out of sheer neglect, and from collections, they land on your credit report for the next six years. Always keep track when you make such changes, by recording the date, the names of the agents you speak to, and your case number. Or, if you are given a receipt, be sure to hang on to it to prove that you cancelled the service.

4. Negotiate a Payment Schedule with Creditors if You Hit a Rough Patch

If you hit a rough patch, such as an extended period of unemployment, do not be complacent about your credit. Call your creditors and negotiate your monthly payments. They will likely be willing to help you because sending outstanding accounts to collections would cost them more money. Cancel or suspend services you can do without, rather than have the bills rack up.

It’s wise to live within your financial means. As the saying goes, “It’s not how much you earn, it’s how much you spend.”

5. Use Services to Track Your Credit History and Maintain a Good Credit Report

Most banks including Scotiabank offer account holders this facility. Alternatively, use free services like Borrowell to monitor your credit. If you notice outstanding payments that you have paid off on your report you should inform the reporting agency in writing so that this may be removed.

What’s in Your Credit Report?

Credit reporting agencies such as Equifax and TransUnion Canada record your credit history. Your credit report will contain information on your:

- Loans

- Credit accounts

- Bills (for example, outstanding cell phone bills can be listed on your credit report)

- Collections items (for example, if an outstanding debt is sent to a collections agency), and

- Legal items (for example, if a court order is issued against you for an outstanding debt).

Collections items stay on your credit report for six years, and legal items stay for ten years. So it’s essential to practice good financial habits that don’t jeopardize your credit rating.

Your credit history speaks volumes to lenders about what kind of risks they take when they agree to lend you money. It takes a long time to build a credit history. Yet, it’s easy to sabotage and takes even longer to rebuild.

So, can you live without credit? Yes. But, should you try to do without it? No. Because without credit, it will be difficult to improve your living standards, at the very least, not as quickly as you would like. And, when it comes to making major purchases such as buying your first home in Canada, a strong credit report is essential. When you manage how you use credit, you’ll remain in good financial standing and be able to secure credit to achieve your important dreams.